If you’re just starting out, investing can feel like an uphill struggle. But with family linking, you don’t have to do all the legwork yourself.

Family linking lets you give a family member privileged access to view your account or manage your investments for you.

How does family linking work?

To set up family linking, firstly the family member you want to give access to must have an AJ Bell account.

‘View only’ access means they can only see your investments.

‘Dealing’ access means they can buy and sell investments for you, as well as view your account.

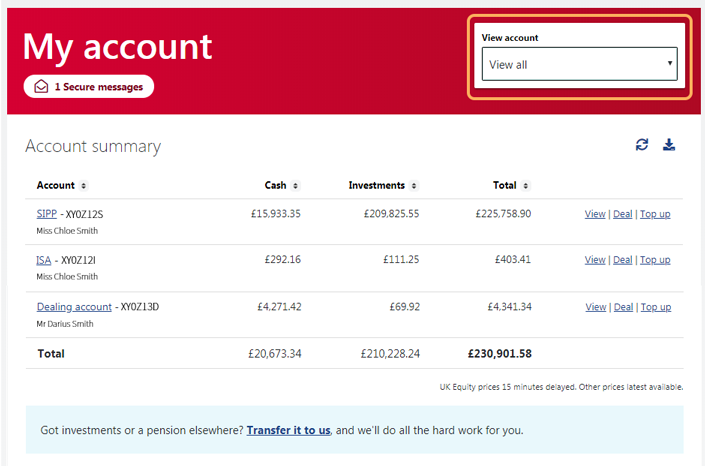

A family member can have access to up to five accounts. They can see all the accounts they have access in the account overview summary, when logged in.

How do I set up family linking?

To set up family linking, first you’ll need to grant access to a family member.

Decide what type of access you want them to have, fill out their details, and submit the request. Your family member will receive an email, which they’ll need to accept, then you’ll be set up.

You can change who has access to your account, and their level of access, at any time. Just log into your account and head to our family linking page.

Before you get started, please see the list of accounts that can and can’t be linked.

To set up family linking on a Junior SIPP account, please fill out a family linking form and either email it to [email protected] or post it to the address on the form.

Family linking with a legal representative

If you’ve appointed someone with power of attorney or a deputy with the lawful authority to act on your behalf, they can manage your AJ Bell account(s) for you.

To do this, they'll need to open an AJ Bell account of their own – if they don't already have one – then they'll need to complete and return our legal representative form and email it to [email protected].

What accounts are eligible for family linking?

*Lead account is the account held by your family member

*Linked account is the account that you’re granting access to

| AJ Bell account type | Can it be a *Lead account? | Can it be a *Linked account? |

|---|---|---|

| SIPP | Yes | Yes |

| Ready-made pension | Yes | Yes |

| Stocks and shares ISA | Yes | Yes |

| Dealing account | Yes | Yes |

| Lifetime ISA | Yes | Yes |

| Junior SIPP | No | Yes - to one account lead other than the registered contact |

| Junior ISA | No | No – only the appointed registered contact can act on the account |

| Cash savings hub | No | No |

| Joint Dealing account | No | No – only the nominated contact can act on the account |

| Bare trust Dealing account | No | No – only the nominated contact can act on the account |

| Designated Dealing account | Yes | Yes |

| Pension scheme Dealing account | No | This account will already be linked to the registered contact’s own account on a dealing basis |

Important information: You should be aware that if you give a family member or representative dealing access to your account, you are giving them permission to make dealing decisions on your behalf, which may put your capital at risk.